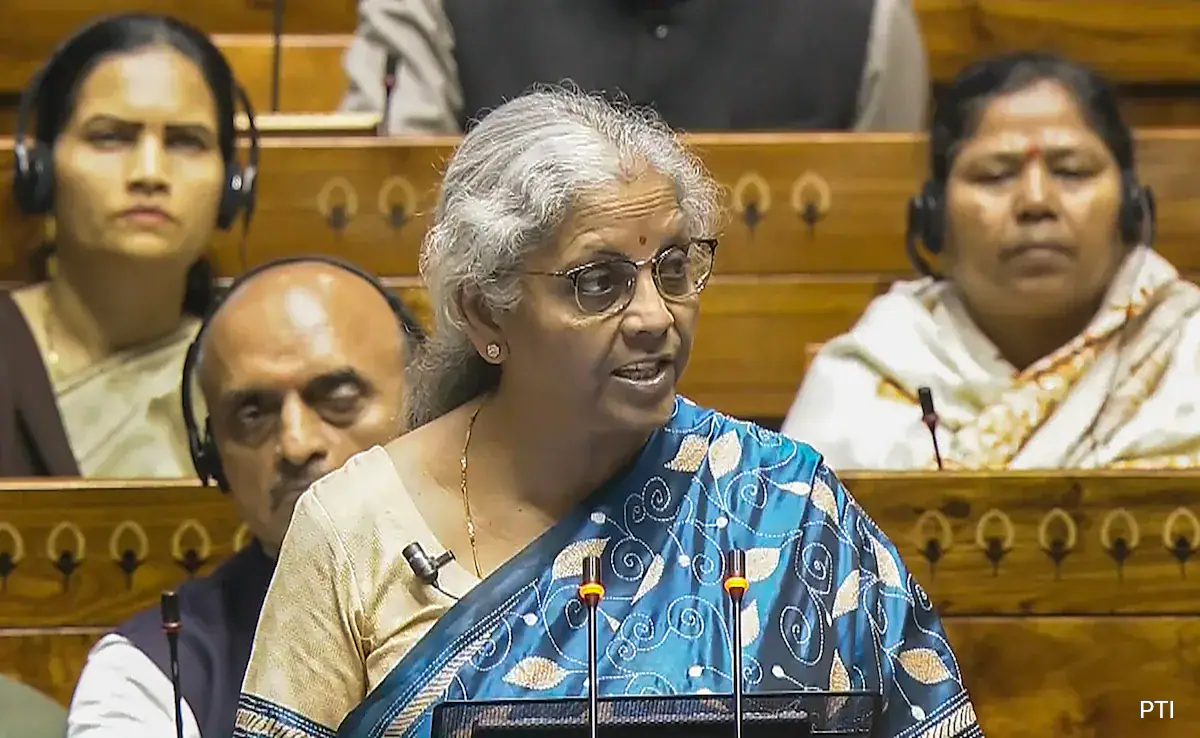

On February 1, 2024, at 7:06:21 PM IST, Finance Minister Nirmala Sitharaman announced the government’s decision to increase the target for “Lakhpati Didi” from 2 crore to 3 crore. The move aims to recognize the success of Self-Help Groups (SHGs) in transforming the rural socio-economic landscape, with 83 lakh SHGs and nine crore women contributing to empowerment and self-reliance. Nearly one crore women have already achieved the status of “Lakhpati Didi,” and the enhanced target reflects confidence in replicating this success.

In a subsequent update at 6:55:03 PM IST, it was revealed that the scheme of a fifty-year interest-free loan for capital expenditure to states would continue for the current year, with a total outlay of ₹1.3 lakh crore.

At 6:47:07 PM IST, Sitharaman announced the extension of the Ayushman Bharat scheme’s healthcare cover to all ASHA workers, Anganwadi Workers, and Helpers. The scheme provides health insurance coverage of up to Rs. 5 lakhs per family per year for secondary and tertiary care hospitalization.

In another development at 6:39:05 PM IST, a housing scheme for the middle class was unveiled. The scheme aims to assist deserving sections of the middle class living in rented houses, slums, or chawls, and unauthorized colonies in purchasing or building their own houses.

Earlier, at 6:30:29 PM IST, it was reported that 78 lakh street vendors had received credit assistance under the PM-SVANidhi scheme, with 2.3 lakh vendors obtaining credit for the third time.

Furthermore, in a dedicated segment on technology at 6:23:03 PM IST, Sitharaman introduced the Interim Budget 2024 using a modern digital approach, showcasing it on a tablet within a traditional red ‘bahi khata’ featuring the national emblem. The budget primarily highlighted key announcements related to various technology sectors.

A broader perspective on the budget’s vision was provided at 6:12:26 PM IST, with Union Minister Piyush Goyal emphasizing Prime Minister Modi’s belief in strengthening the common man’s ability to contribute to the national economy. Goyal described the budget as visionary, outlining how 140 crore Indians could contribute to making India a developed nation.

The Finance Minister, in response to a question at 6:02:14 PM IST, confirmed that despite disturbances in the Red Sea, the India, Middle East, European Corridor (IMEC) project would be taken forward. She mentioned consulting and considering all aspects of the project.

Finally, at 5:42:21 PM IST, key takeaways from FM Sitharaman’s post-budget press conference were summarized, highlighting the focus on social justice, GDP growth, fiscal consolidation, continued government capital expenditure (capex), and the pursuit of the India, Middle East, European Corridor project. The government’s commitment to aligning with the fiscal consolidation path and reducing the Centre’s debt-to-GDP ratio was emphasized.

In the Budget Estimates (BE) for the fiscal year 2024-25, Finance Commission grants are projected to amount to ₹1.32 lakh crore. The Central Government’s expenditure on pensions is expected to reach ₹2.40 lakh crore in the same period, constituting 0.7% of the estimated GDP.

For the fiscal year 2024-25, which marks the fifth year of the 15th Finance Commission (FFC) award period, tax devolution to the States, based on FFC recommendations, is set at ₹12.20 lakh crore, equivalent to 3.7% of GDP. This is a significant increase from the estimated ₹10.21 lakh crore in BE 2023-24.

Additionally, in the live updates provided, the Finance Minister announced a corpus of ₹1 lakh crore for India’s tech-savvy youth to encourage research and innovation in sunrise domains. The focus of the Budget was on fiscal consolidation, infrastructure development, agriculture, green growth, and railways. However, there were no changes in tax rates, which disappointed salaried individuals. Prime Minister Narendra Modi emphasized that the Budget guarantees strengthening the foundation of a developed India, empowering the young, poor, women, and farmers.

Other key highlights include the extension of certain benefits to start-ups and tax exemptions for specific International Financial Services Centre (IFSC) units until March 2025. The budget also allocated funds to various ministries, with notable amounts earmarked for the Ministry of Defence, Ministry of Road Transport and Highways, Ministry of Railways, and others.

In the macroeconomic context, the fiscal deficit target for FY25 is set at 5.1% of GDP, with a focus on reducing it to below 4.5% by FY26. The gross market borrowing for FY25 is estimated at ₹14.13 lakh crore, with net borrowing at ₹11.75 lakh crore. The Budget also outlined measures for ‘net-zero’ commitment by 2070, including offshore wind energy, coal gasification, and mandatory blending of compressed biogas.

Furthermore, the Finance Minister announced initiatives for sectors like agriculture, food processing, dairy development, and Matsya Sampada schemes. The budget emphasized infrastructure development, with an 11.1% increase in the infrastructure outlay to ₹11.11 lakh crore. A 50-year interest-free loan to states under the Gati Shakti master plan was extended, and railway corridor programs were introduced.

The Budget Estimates for FY 2024-25 highlighted total receipts (excluding borrowings) at ₹30.80 lakh crore, total expenditure at ₹47.66 lakh crore, and tax receipts at ₹26.02 lakh crore. The revised estimates for FY 2023-24 indicated total receipts (excluding borrowings) at ₹27.56 lakh crore, tax receipts at ₹23.24 lakh crore, and total expenditure at ₹44.90 lakh crore. There were no changes in direct and indirect tax rates, and the average processing time of tax returns was reduced to 10 days. The government also proposed to withdraw outstanding direct tax demands up to ₹25,000 for the period up to FY 2009-10 and up to ₹10,000 for FY 2010-11 to 2014-15, benefiting around one crore taxpayers.